Measuring up the Ballot: Proposition HH

October 13, 2023

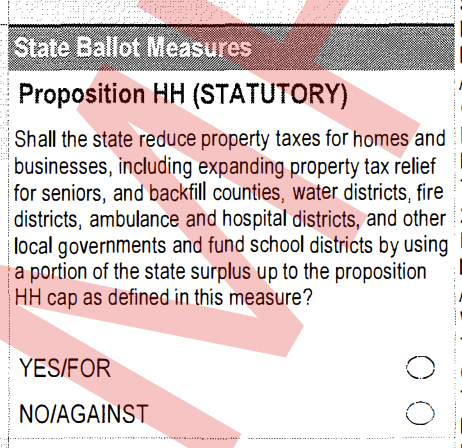

Proposition HH as it appears on a Sample Ballot.

Many property owners in San Miguel County were shocked earlier this year when they opened their latest assessments and found the home values had jumped 40, 50 or even 75% over levels from only two years ago. The drastic increases in value are a product of Colorado’s pandemic real-estate boom, and are being felt state-wide.

And while an increase in value may bring financial benefits to some homeowners, it can also mean higher property taxes. The potential tax increases have caught the attention of the San Miguel Board of County Commissioners.

“And I know from speaking with Commissioners individually they’re wishing to provide additional tax relief to their residents knowing that so many San Miguel County residents are on fixed incomes or have owned their homes for a long time and might not be able to bear the dramatic potential tax increases,” ,” says county Manager Mike Bordogna.

Over the past couple weeks, the Commissioners and county staff have been discussing Proposition HH, which is a state-wide ballot measure appearing before Colorado voters this fall.

HH would work like this: it cuts the property tax assessment rate in Colorado for a period of ten years, and limits increases in property tax collections. Over time, it would save property owners hundreds of millions of dollars across the state.

At the same time, however, the proposition would lower TABOR refunds over the same ten year period. That money, which is usually returned to taxpayer pockets, would stay with the state, and the state would distribute the TABOR funds to schools, counties, and other entities in order to make up for lost property tax revenue.

So, as Commissioner Anne Brown explains it, if the Proposition passes, “while people will have lower property taxes they will also have — with Proposition HH — lower TABOR refunds and that is something that people in this state really count on in their financial budgeting and so forth.”

Calculating exactly who will benefit if both TABOR refunds decline and property taxes are cut makes for tricky math. Among county governments, however, says Brown “the grave concerns by those opposed to it are the fact that it tips the balance of power in the favor of the state by them retaining more of our TABOR refunds and then opting to backfill the counties for that.”

So rather than having direct control over its revenue, the county will depend on the state to send tax money its way.

In the end, however, weighing the pros and cons of Prop HH for San Miguel County voters, and for the county government, brings about no clear answers. “And I feel a little weak,” Brown says, “because I think the public will be looking to us for guidance on what makes sense for San Miguel County but at this point I’m not sure we fully know.”

As such, the commissioners decline to take a position on Prop HH. Voters will be faced with the question on the 2023 ballot, and will have to consider the benefits of TABOR, versus the benefits of a property tax cut, in their own finances.

Regardless of the outcome, the Commissioners are continuing to look at ways to provide tax relief to county residents above and beyond the efforts laid out by Proposition HH.

Recent News

Off the Record-Norwood and Wrights Mesa Local Ballot Initiatives

October 16, 2024

Mason Osgood KOTO news team hosted an Off the Record live broadcast at the Lone Cone Library on October 15th. Guests joined for a discussion [...]

Proposition 127: Big Cat Hunting

September 26, 2024

By Julia Caulfield Photo: Priscilla Du Preez KOTO Community Radio · KOTO Election Special 9-26-24: Proposition 127 Big Cat Hunting Colorado voters will weigh in [...]

Norwood Public School District Looks to The Future

September 25, 2024

By Mason Osgood This November, the Norwood Public School district is asking voters to help fund their future. Ballot Issue 5B is a mill levy [...]